From 1 January 2023, self-employed workers in Spain (autónomos) face a series of changes regarding the compulsory monthly contribution for self-employed workers.

Of the main changes applicable from this date, the following stand out:

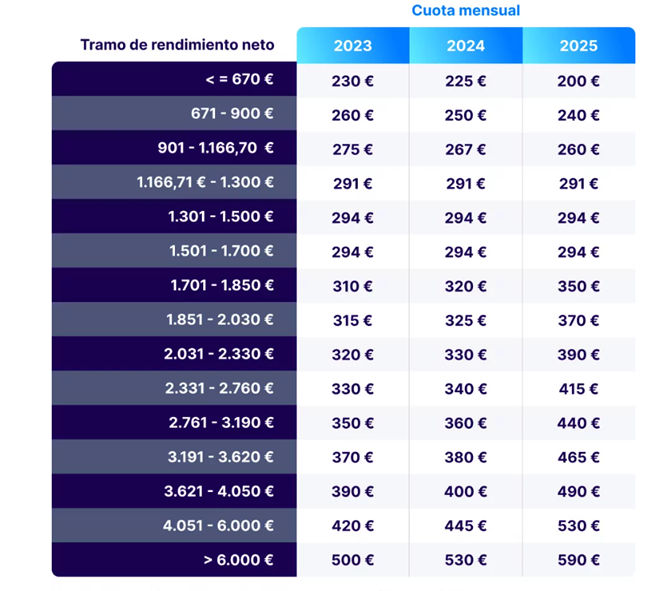

- 15 different contribution scales (tramos de cotización) have now been established, with each self-employed person’s net income determining which scale they fall into. Thus, self-employed people earning less will pay a lower contribution, while self-employed people with higher incomes will have to pay a higher contribution. The employer himself can change his contribution scale up to six times a year. The table is as follows:

In the table, Tramo de rendimiento neto means net income and Cuota mensual means monthly contribution.

The monthly contribution you determine in advance each year as a self-employed person are provisional until the annual regularisation of the contribution takes place. At the end of the calendar year, the Tax Administration will provide the Social Security Administration (Tesorería General de la Seguridad Social/TGSS) with information on the actual annual income received. If the contribution chosen during the year is lower than that associated with the income reported by the corresponding tax administration, the self-employed person will be notified of the discrepancy in the amount. This discrepancy must be paid before the last day of the month following that in which the notification of the result of the regularisation was received.

If, on the other hand, the contribution paid is higher than that corresponding to the maximum base of the tranche in which the income falls, the Social Security Administration refunds the difference before 30 April of the financial year following the one in which the tax department concerned notified the calculated income.

- The current flat fee during the first year of self-employment has been repealed. Instead, a reduced rate has been introduced for new self-employed persons who decide to register with the Social Security Administration during the first two years;

- Measures will be taken to avoid penalising self-employed workers with seasonal incomes (e.g. tourism workers) in terms of high contributions during periods when they are not working;

- Reimbursements and reductions in contribution rates will be extended to self-employed workers who have employees under contract, who employ women and young people or who have disabilities.

Lucia Guillen Molina